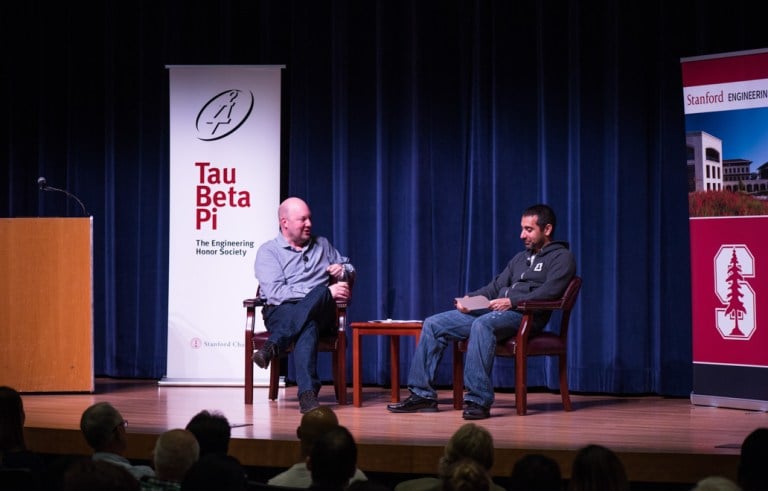

On Wednesday, the Stanford chapter of the engineering honor society Tau Beta Pi hosted a fireside chat with Marc Andreessen and Balaji Srinivasan as part of the Tau Beta Pi’s Distinguished Speaker Series.

Andreessen is one of Silicon Valley’s most prominent figures, having cofounded Netscape and the software company Loudcloud, which sold for $4.2 billion and $1.6 billion, respectively. He has since been general partner at the Menlo Park-based, multibillion-dollar venture capital firm he confounded, Andreessen Horowitz.

Srinivasan is a general partner at Andreessen Horowitz as well as CEO of the bitcoin infrastructure company he cofounded, 21. Srinivasan has also taught in Stanford’s statistics department and runs the Stanford Bitcoin Group.

The packed event, which overflowed into the aisles, consisted of Srinivasan asking Andreessen questions from a list, with Srinivasan also frequently offering his own take.

Andreessen opened by talking about how Andreessen Horowitz started, recounting how, after being a multiple-time consumer of angel investing, he became interested in the practice.

“You start to think, ‘Maybe I can do this,’” he said.

Andreessen Horowitz sought to follow the startup philosophy of diverging from the traditional and characterizes itself as different from the majority of venture capital firms in two major ways. The firm hired general partners who were all company founders or CEOs and built a nontraditional structure of 85 full-time, non-partner professionals versus the two or three professionals most firms have to offer a pre-built network to new companies, so that they wouldn’t have to fire their founders and bring in a professional CEO who would have that network.

The two then went on to reflect on the evolution of the venture capital landscape in the last seven to eight years.

“There’s been more change in venture capital in the last seven years then in the preceding twenty,” Andreessen said. He also said the growth of venture capital paralleled the rapid change in technology over the same timeframe.

Besides the emergence of many new firms, such as the San Francisco-based Founders Firm and GV, the rebranded Google Ventures, “angel investors have been renaming themselves as seed investors. Angel implies an individual, whereas seed represents an investable asset class, and are investing from seed firms instead of out of their pockets.”

The effect is that firms are now pursuing several rounds of seed funding instead of jumping right into raising venture capital. Andreessen reflected how the restructuring of the industry has led to the proliferation of new terms such as “pre-seed funding,” “post-seed funding” and “early-A funding,” to the laughter of the audience.

When asked what sort of formula his firm employs in choosing companies to invest in, Andreessen laid out how the general formula can be distilled down to market, product and team. Andreessen recommended that prospective entrepreneurs pay special attention to the last.

“Focus on team,” he said. “Even if it’s the wrong market or wrong people, you’ll still learn so much working with the right people, you’ll build such a valuable network for whatever you do next, it’s worth biasing about 90 percent in favor of people.”

Andreessen added that other investors preferred more elaborate criteria: “Peter Thiel [has] like 600 factors in his head that he hasn’t told anybody about. And I haven’t succeeded in getting him drunk enough to find out what they are.”

On hot topics in tech, Srinivasan talked about how he is optimistic about bitcoin despite its decline since 2013.

“The technologies to look at are those that people have written off. You know, VR after Second Life,” he said, in reference to the 2003 online virtual world.

The two both expressed great enthusiasm for virtual reality and augmented reality, declaring “magic is happening” and that “the world is divided into two groups of people, people who haven’t tried the shipping version of Oculus and think it’s stupid, and the people who have tried it and think it’s the future of everything.”

Andreessen and Srinivasan also had advice for students.

“Don’t do a startup unless you’re ideologically driven to make it succeed beyond the economic motivation,” Srinivasan said. “Elon Musk said ‘Starting a company is like chewing glass and starting into the abyss. After a while, you start like the taste of your own blood.’ It’s like being the world’s most unattractive person looking for a date, being told no, no, no.”

What stood out was the caution both had for the would-be Mark Zuckerbergs – that Mark Zuckerberg is who he is because there aren’t many of him, that many “startups die in obscurity” and that skill acquisition is the most important skill for an entrepreneur, which takes time.

Andreessen shared how he’s concluded the answer to the moral dilemma of giving advice to people contemplating dropping out of school is to always advise completing a degree, because “the people who are going to drop out and start a company will do it regardless of what I say.”

Contact Ryan Jae at ryanfong ‘at’ stanford.edu.