It is summer internship season at Stanford: February saw the passing of many application deadlines and now students’ email inboxes are flooded with interview requests, job offers and rejections. Students face tough decisions about which summer opportunities to pursue and accept — but some must take financial ability into higher consideration than others.

Stanford expects students receiving financial aid to contribute a “student responsibility portion” toward their tuition each year from academic year and summer earnings. For most students with financial aid, the expected student contribution is at least $5,000: $2,200 from summer job earnings and $2,800 from academic year job earnings. The specific amount varies based on students’ personal assets and savings.

Students pursuing internships at non-profits or other public service organizations often face challenges covering this contribution, as a majority of the opportunities are unpaid.

Stanford’s Haas Center for Public Service works to address financial barriers to interning in public service. The Center’s Cardinal Quarter fellowships and grants provide funding for internships focused on social or environmental impact, while its Community-Service Work-Study (CSWS) program uses federal funds to pay eligible students $15 per hour to work for a community organization of their choice.

Haas Center’s senior program director Jon McConnell said many of Haas’s programs were founded because students did not have the resources to pursue unpaid service-learning internships during the summer.

“The goal is to provide funding for opportunities that would otherwise not be funded and to make them more accessible to all students,” McConnell said.

The majority of summer grants and funding opportunities at Stanford offer at least $5,000 intended to cover housing, food, transportation and other living expenses.

According to an analysis by Time, this may not be enough.

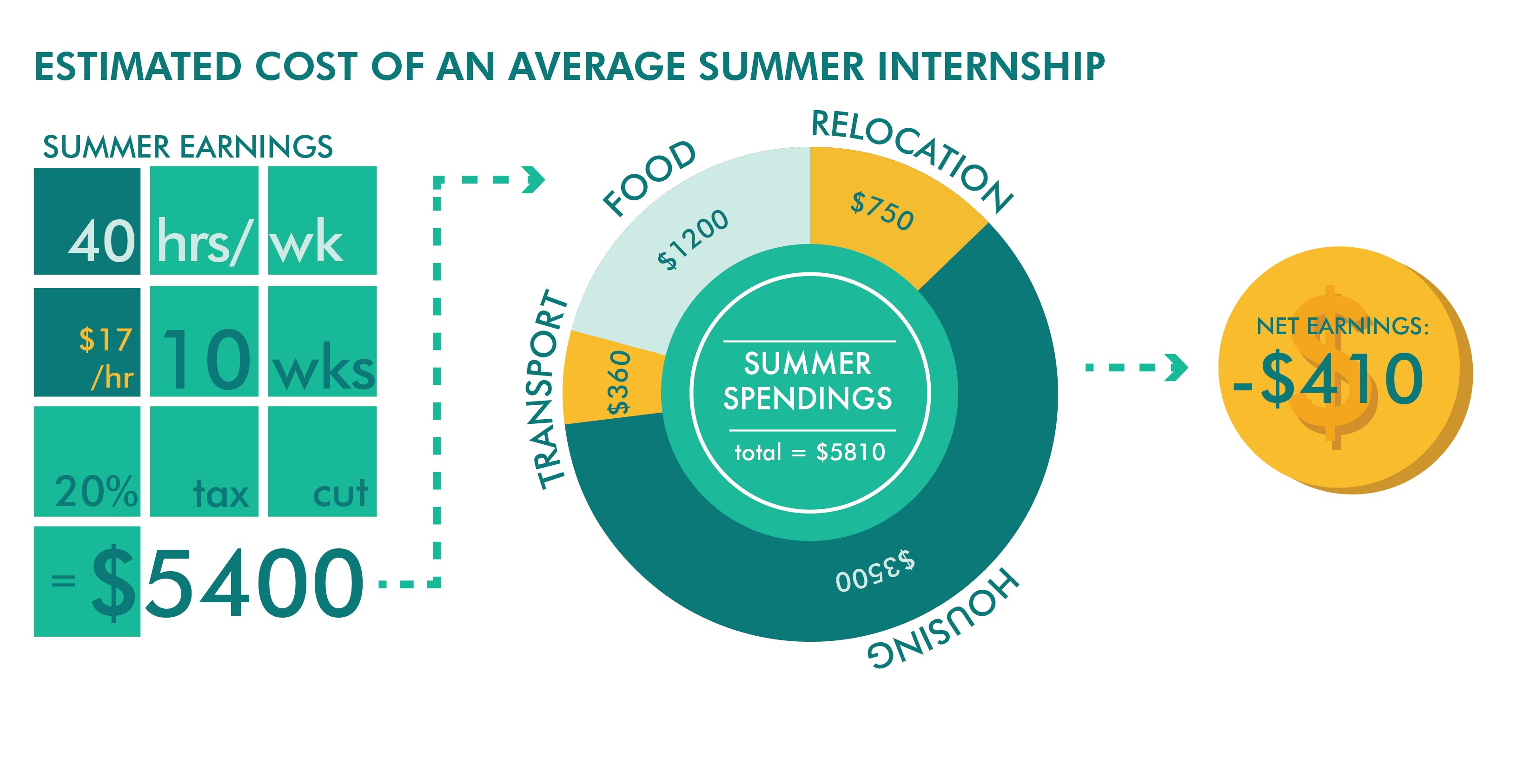

Last April, Time found that participating in a 10-week summer internship away from home costs $5,810 on average: $750 for relocation, $3,500 for housing, $360 for transportation and $1,200 for food. Therefore, a student earning a $5,000 fellowship award can anticipate a net loss of $810, and even paid internships can result in students breaking even or losing money.

As a result, many students are limited in what summer internships they can accept. Some students decide to look solely at jobs in their hometown, where family can provide food and housing, while others pursue only paid positions, mostly at for-profit companies. Others must work more during the school year or take out student loans.

Stanford director of financial aid Karen Cooper acknowledged that the student contribution portion of a financial aid package may ask students to consider finances before taking a summer job offer, but she explained that students can choose how they want to meet their expected payment.

“If students want to take a great opportunity during the summer, and they want to make up for that by working more during the academic year, that’s fine,” Cooper said. “[Or] if you’ve got an opportunity for a great internship that’s going to help you in your career — to take away one summer or $2,000 in student loans isn’t going to hurt you in the long run.”

Some students agree with Cooper. This summer, Adrian Vega ’19 will be working in digital content production at the Trevor Project, a suicide-prevention organization focused on LGBTQ+ youth.

“Coming into college, I was very adamant about not wanting to graduate with loans,” Vega said. “But for the right position and for something I’m truly passionate about like the Trevor Project and the work I’d be doing, I would consider a loan… I don’t want my inability to finance this summer to be a reason why they don’t take me.”

Vega is applying for a fellowship through the Haas Center, but he thinks he will still lose money this summer.

“This fellowship has a base stipend of $5,000, but $5,000 [in Los Angeles] gets you rent for the nine weeks I’d be working,” Vega said. “On top of that is transportation, utilities, groceries, everything else that goes into living by yourself for a summer.”

Vega plans on preparing for this summer by saving more of his income from his on-campus job, but he said he would take out a loan as a “last-resort.”

Others students are less willing to accumulate debt. Julia Busby ’19 said she would not feel comfortable taking out loans for a summer internship.

“I don’t really want to be in debt, and summer is a thing I look at as a way to make money rather than lose it,” Busby said.

Busby is applying for a Cardinal Quarter fellowship in Washington, D.C. Because her interest is in nonprofit work, she does not expect financial support from the organizations she applied at.

McConnell said the Haas program has recently added financial aid supplements to many fellowship awards so students can afford expenses associated with a public service internship. Some awards include an additional $500 stipend if students are traveling abroad or to a high-rent area, and some students qualify for an additional $2,200 to meet their summer earnings requirement.

However, additional funding is still in progress for the CSWS program.

“For CSWS, we’re working with financial aid to increase that amount … so that it’s more on par with the fellowship awards, because historically it’s been a little less than what students could get through fellowships,” McConnell said.

“Our goal is always to try to make these opportunities fully accessible to all students,” McConnell added.

Contact Tia Schwab at kbschwab ‘at’ stanford.edu