The student budget is real, and the stress of managing one’s income and expenses is a common experience. Fortunately, Stanford’s campus is full of resources, from job opportunities to on-campus organizations to tips from fellow classmates, that give students the support they need to navigate the murky waters of student budgeting.

Campus Jobs and Resources

In terms of earning money, many Stanford students take advantage of work opportunities on campus, like Kyle Enriquez ’20, who works at the Stanford student store and a campus lab over the summer.

Institutional resources are also available, one of which is the First-Generation Low-Income Partnership (FLIP), a student organization on campus that provides financial support and resources to Stanford students. Alex Fuentes ’20, a member of FLIP’s core, explained that FLIP’s mission is two-fold: to directly provide resources and to cultivate a conversation about socioeconomic issues.

“FLIP actively advocates for first-generation/low-income student needs while also raising awareness of class issues on campus,” Fuentes said. “We help coordinate financial literacy events such as a tax workshop each year, as well as provide food to students who are on campus during school breaks through events like the FLIP Thanksgiving Dinner.”

FLIP also offers financial resources that can be utilized by all Stanford students. According to co-president of FLIP Elen Mendoza ’18, every year, FLIP publishes a “Working at Stanford” guide, which provides a comprehensive list of both on and off campus jobs and is working on the development of an app that lets students know of events where free food is being offered on campus.

Spending resourcefully

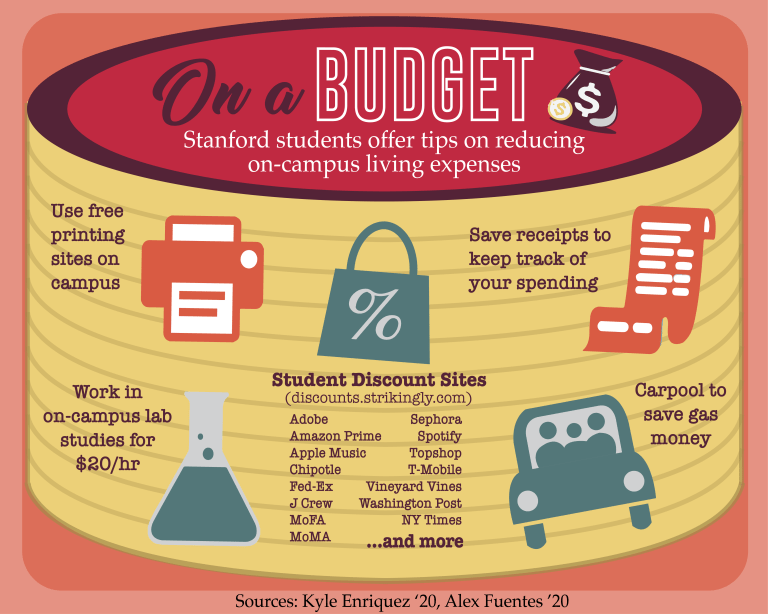

As for smart ways to manage the cost of one’s spending, Fuentes offered some personal tips, suggesting that fellow students carpool to split the cost of gas, take advantage of the free printing sites on campus and cash in on student discount sites. He also suggested participating in on-campus lab studies, in which students can make $20 cash per hour.

“Carrying cash makes me less likely to spend, so my ‘lab money’ fund is what I usually use to go out or buy snacks,” Fuentes said.

Regarding textbooks, Mendoza said that, since the cost of books can add up, she likes to either rent books from the library or purchase older editions of texts, which are usually cheaper. Fuentes suggests that students look for e-book or PDF versions of their textbooks or ask to borrow or purchase books from other students who have previously taken the course.

According to Mendoza, students can also order to-go lunches from almost any dining hall. For students on the meal plan, she suggested picking up a to-go lunch when they have to run rather than paying for lunch on the go.

Enriquez also offered some tips on keeping track of his expenses. He keeps receipts from all his purchases to help him keep track of how much he is spending.

“I keep all my receipts in a drawer in my desk,” Enriquez said. “I’ll just throw whatever receipt I got from the day or every couple of days into the drawer so that way I have them in case I need them.”

While life as a college student may be stressful, managing your finances doesn’t have to be. From tips and tricks to financial support, Stanford offers a bounty of resources that provide a helpful guide to any student budgeting experience.

Contact Amy Guo at acguo29 ‘at’ gmail.com.