This article is the second of two installments in a series on Stanford’s entrepreneurial ecosystem. Read part 1 here.

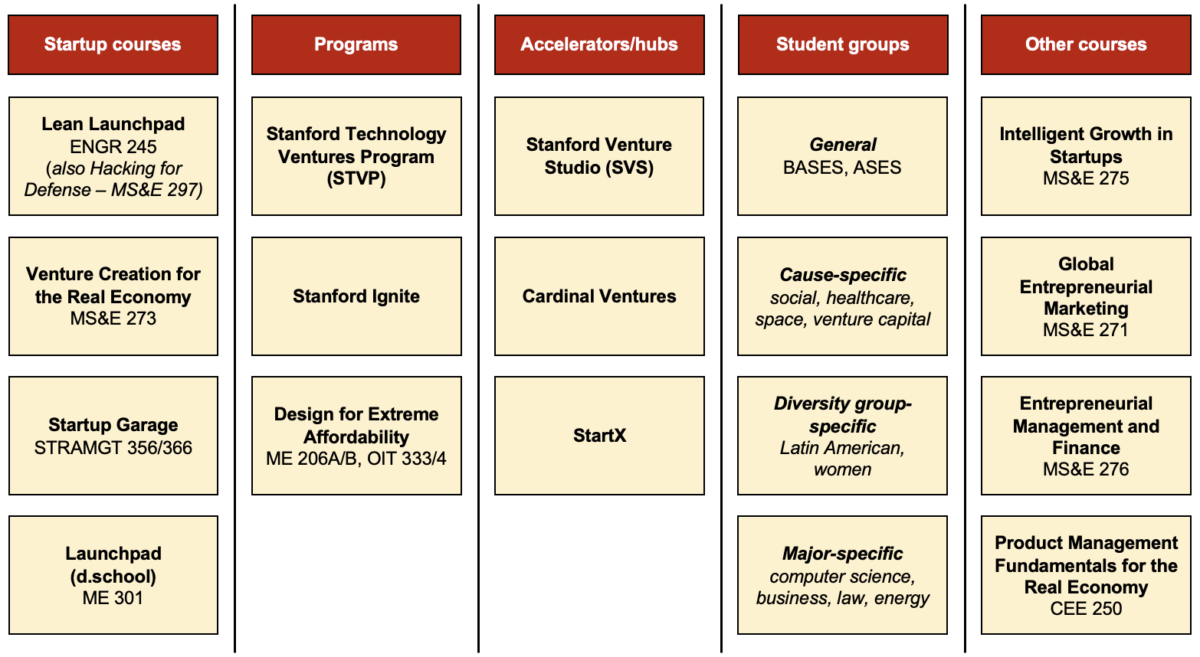

Stanford’s vast entrepreneurial ecosystem, a network of courses, programs, accelerators and student groups, deliver hands-on entrepreneurial education and support the creation, growth and funding of startups and ventures — brand new companies or businesses.

As a guide for the uninitiated, The Stanford Daily interviewed Stanford undergraduate and graduate students who have experienced the most popular of these resources for their insight and perspective.

While this series of articles aims to present the most popular and well-known resources that Stanford offers, more exhaustive lists are maintained by the Stanford Entrepreneurship Network and Cardinal Ventures. Course offering lists include those maintained by the Stanford Technology Ventures Program and Graduate School of Business.

Programs

In addition to quarter-long courses, Stanford’s entrepreneurial ecosystem includes cohort-based, structured programs designed to significantly deepen students’ skills in entrepreneurship. Three leading programs are the Stanford Technology Ventures Program (STVP), Stanford Ignite and Design for Extreme Affordability. Each respectively come from one the three main entrepreneurially involved schools: management science (the Department of Management Science and Engineering), business (the Graduate School of Business) and design (the Hasso Plattner Institute of Design, or “d.school”).

The Stanford Technology Ventures Program (STVP) is the entrepreneurship center at Stanford’s School of Engineering and is run by the Department of Management Science and Engineering (MS&E). It encompasses courses, programs and speaker series, and runs four selective year-long fellowship programs: Mayfield Fellows, Threshold Venture Fellows, Accel Leadership and Peak Fellows — ranging from 12 to 24 student admits each. These programs seek to develop an entrepreneurial mindset in students within a tight-knit, motivated cohort. It also hosts a popular one-unit course that is also open to the public: Entrepreneurial Thought Leaders’ Seminar (ETL). Its weekly line-up of speakers frequently includes C-level executives from Silicon Valley, startup founders, vice presidents of organizations and venture capitalists. Venture capitalists are investors in startups that provide funding after critically appraising them, which includes hearing the founders “pitch” their plans and ideas and interviewing them.

As a 2020 Threshold Venture Fellow (TVF), Mallika Khullar M.S. ’21 thoroughly enjoyed the program, from the people, discussions and doors it opened. The program is run by professor Tina Seelig and Threshold Ventures Partner Heidi Roizen. “People in the cohort are generally extremely driven and motivated; everybody comes with a rich background in something different and the cohort usually features a healthy mix of students from all over the world,” she wrote as part of an interview with The Stanford Daily. “So the discussions throughout the year are fueled with very diverse and usually informed opinions,” she added.

The fellows are connected to a strong mentorship network. “Everybody is paired up with an [ex-TVF] mentor [and] an industry mentor, like a [venture capitalist] or an entrepreneur, or somebody who is from a bigger organization. We [had] events where all of these people were present,” Khullar said. Her industry mentor was a board member at several startups in Silicon Valley, and whose advice she found “extremely valuable … detailed and concrete.”

The cohort of 12 met twice a week — once on Tuesdays at Selig or Roizen’s houses, involving brainstorming sessions and team building activities over meals, and once on Wednesdays after watching the ETL seminar to dig deep into their entrepreneurial themes. “We bonded a lot over poignant discussions; some of us opened up and were extremely vulnerable with each other. We are all still in touch and help each other out through times of need — till date!” she said. For her, one of the most valuable parts of the program is the network she now has, with industry experts, TVF alumni, mentors and classmates.

However, TVF, along with the three fellowship programs in STVP, is selective. The application process has two rounds: a written application and a group discussion, with the latter stage having about a 40% acceptance rate. “For the written application, since it’s an entrepreneurial leadership fellowship, it’s important to show them that you’ve got an entrepreneurial spirit and/or experience building your own impactful solutions to the world’s problems,” she said. “For the group discussion, Heidi and Tina are the very best. They’re great conversationalists and the group discussions are fun and open-ended. Just be yourself, be authentic, tell all the compelling stories you have and try and build a connection with the other people in your group discussion as well as with Heidi and Tina.”

Additionally, though the TVF program is focused on developing entrepreneurial leaders, the application doesn’t require having a startup idea in mind. Rather, “the application form is very heavily focused on you as a person, what kind of background you come from and what kind of stories you have to tell, so you don’t necessarily have to have an idea in mind, nor do you have to have startup experience as such,” she said. “You just need to know what it means to want to start something which might have impact.”

The Stanford Ignite Executive Education program is another cohort-based program, but with a focus on creating ventures and developing new products. Run by the Graduate School of Business (GSB), it takes place over eight weeks (part-time) or four weeks (full-time). Each cohort has 60 to 80 people, with half from the student body and half being working professionals. The program teaches participants how to formulate, develop and commercialize new ideas, touches on all areas of business operations and has an experiential learning component where teams collaborate on a venture project. As a course taught by the M.B.A. faculty, it is aimed at professionals with a bachelor’s degree and prior experience with advanced degrees preferred, or graduate students in non-business fields, rather than undergraduates without experience or business majors.

Ryanne Ramadan M.S. ’21, a member of the January 2020 cohort, who worked on an education-sector project to prepare students for careers of the future, described it as a “mini M.B.A. experience.” She pointed to the content, connections and experience as highlights. “We formed teams and worked on projects throughout the course of the eight weeks. As we’re learning these fundamentals, we had to build a pitch, and at the end of it, we got to pitch to venture capitalists and get feedback on our presentation,” she said. “So it’s kind of like you’re learning the books, but at the same time you’re applying the material.”

Each session covered a different aspect of entrepreneurship, as well as primers on core business school classes such as marketing, finance, accounting, strategy and operations. “All the class courses were taught by GSB faculty, and they were the best — they were super highly specialized in their field, and you could go up to them after and ask them questions,” she said of the teaching team. “They would lecture super interesting stuff and give you resources if you wanted to dive in more.” Ramadan said that they also did a lot of case studies — a popular business school teaching method which typically summarizes real business scenarios to illustrate the application of business theory and help students develop business acumen.

Participants can have a venture idea beforehand, but don’t have to. “On the first day, everybody pitches their idea, and people vote, and then based on that, you’re paired into groups, and either your idea is selected or it’s not,” Ramadan explained. “The project I worked on was totally from scratch. Another [participant] had a biotech company — she already had it running — but they helped her grow it and think outside the box and really develop a more solidified business plan over a period of time.”

A year on, her cohort, made up of masters, Ph.D. and postdoctoral participants as well as highly accomplished industry professionals, has a camaraderie that is still going strong. “All of us are still in the [same] group chat,” she said.

As with all other Executive Education programs from the GSB, Ignite continues to be offered during the pandemic with virtual instruction, but maintains its immersive and comprehensive nature, generous access to the teaching team and ability to facilitate strong connections through activities like team building and organized coffee chats.

The Design for Extreme Affordability program from the d.school, unlike other startup courses and entrepreneurial programs, partners with organizations based in developing countries for immediate impact, and may lead to student startup ventures. It is a two-quarter program (across winter and spring) where students learn to design products and services that will impact the lives of the world’s poorest citizens, working with international partnering organizations to implement their designs. The program admits 10 teams of four students each, and has a 40% acceptance rate. Partner organizations come from developing countries across the world, including Ghana, Tanzania, Costa Rica, the Philippines and Nepal. Over the spring break, two students from each team also travel to the project sites to meet with their partner organizations and conduct needfinding on the ground. Following the course, teams can continue at the Social Entrepreneurship Lab, a center associated with the program, which provides funding, space and mentorship over the summer, after which teams that continue typically become revenue-generating startups and apply for venture capital funding.

Aishwarya Venkatramani M.S. ’21 was part of the 2020 cohort and worked with a Ghana-based organization to design a healthcare wristband and app. The program was a “game changer” for her time at Stanford. “What I intended to do at Stanford and what I ended up doing changed because of Design for Extreme Affordability, in a good way,” she said. “I came in as a Ph.D. student wanting to do research [but] in the back of my mind I always wanted to do something [that could] be taken into a real-world setting.” During the course, she said, “you go out to the community that you’re designing for … I was particularly interested in taking healthcare ideas into a developing country, and it was a great opportunity for that.”

The beginning of the program starts with learning and applying the design thinking methodology while getting to know partner organizations and classmates. After the first two weeks, students list their preferences of what projects they want to work on, the team members they want to work with and whether they are interested in traveling to their partner sites abroad. The first quarter is more content-focused, while the second quarter sees teams more independently directing their activities as they continue to work with their partner organizations. For the most part, it’s also up to the teams to determine the pace of interactions with their organization. “We usually reach out to them after we realize we want to do interviews with people on the ground or doctors that we want to work with,” Venkatramani said. “They [the teaching team] also do a session in class on how to work with your partner [organization], how to work with them across time zones and what is a professional way of talking to them.”

The program, being selective, involves a written application followed by a group activity interview. For Venkatramani, in the group activity which spanned an evening, students were put in teams of four to five and provided a set of materials to build something the teaching team specified. According to the website, students are then selected based on “passion for the class, proclivity to make things and prior experience in addition to their discipline.”

Venkatramani says that this course is relevant for anyone interested in design and its real-world applications. “A lot of companies have come out of it, they’ve incorporated, [some] with a couple of hundred employees,” she adds. There is also a large community of designers, investors, legal counselors and industry experts to help with student ventures for program alumni. Other similar programs which can also lead to startups and institutional funding, albeit without partnerships with developing world organizations, include one- and two-quarter project course sequences from The Stanford Byers Center for Biodesign.

One year on, Venkatramani is still in touch with their partner organization in Ghana. “We still talk to them once every other week, and exchange emails pretty often,” she said. “They are our customer, so they’re paying for what we’ve developed, and they’re funding us to travel to Ghana.”

Accelerators/hubs

Accelerators are fixed-term, cohort-based programs led by seasoned entrepreneurs that help startups establish a strong business foundation and fast-track their growth. Hubs loosely refer to networks of aspiring and experienced entrepreneurs and resources. Of these, the Stanford Venture Studio (SVS), StartX and Cardinal Ventures are the most widely utilized on campus.

Stanford Venture Studio, from the Graduate School of Business, is an entrepreneurship hub that supports students exploring venture ideas with an extensive network, discounts and free resources like for coding credits used for computer science projects, 24/7 access to coworking space and advice and mentoring from industry experts. They also have mixers to help people form founding teams. Admission is non-competitive — it is guaranteed for any Stanford-affiliated students that submit an application form.

For Chelikavada, the Stanford Venture Studio’s community through its email chain and office hours have been invaluable for making progress on his own venture. “People who are subscribed to [the email chain] are current students, alums, founders, investors, VCs,” he said. Any time someone posts in the group, everyone that’s subscribed to the group receives that message. “It’s very powerful,” he said. “When I posted about an idea that I was working on, I had a bunch of [venture capitalists] email me [back]. And they’re like, ‘Wait, this sounds interesting. Do you want to talk?’ I [also] had a YC [Y Combinator, an accelerator] interview, and I found people to mock interview [with] me through Venture Studios.”

Ramadan, who also signed up with the Stanford Venture Studio, agrees. “I think the biggest thing is that it connects you to a bunch of other entrepreneurs … [with the] email chain, if I have any questions, I literally just pop it in this chain and I get like four or five responses back and vice versa. People just kind of ask for help, and this extends beyond graduation,” she said.

The venture studio also offers frequent office hours with industry experts. “For example,” Chelikavada said, “there are people that have done it before, [such as] someone that started a massive company, and that they’re an expert in the [business-to-business] space.” He added, “they’re always helpful, not just to get advice on product or marketing, but also to build relationships with these people.” With very specialized experts, he would sign up for the office hours on the topics he needed help with. “I’d talk through any challenges that I’m facing and how I’m attempting to solve them and see if there’s a better way to solve them,” he said. “Also, if you [build a strong rapport] with them, it’s a good professional relationship to have — then you can go to them even outside of office hours,” he added.

Two other popular, albeit selective, forums to engage with the entrepreneurial crowd at Stanford are StartX and Cardinal Ventures. Both have accelerator programs that are equity-free, meaning that they do not take any shares of startup companies that they work with, an otherwise common practice for accelerators.

StartX is a non-profit Stanford-affiliated entrepreneurial network that is well-known for its Student in Residence (SIR) accelerator program, specifically for Stanford students, which includes a $9,000 scholarship and six months of support. More broadly, according to its website, its network encompasses “1200+ serial entrepreneurs, industry experts, tenured Stanford professors and 700+ well-funded growth stage startups,” to which access by application is open to Stanford-affiliated teams, including alumni and professors. Both of these programs are competitive, with an acceptance rate of around 8%.

Cardinal Ventures is an equity-free student-run accelerator for Stanford students. It runs a 10-week long program twice a year, in the fall and spring quarters, for 12 to 20 admitted teams who may be anywhere from the idea stage up to seriously seeking institutional funding. They provide an extensive entrepreneurship curriculum as well as a community of founders, mentors, angel investors and legal and financial expertise.

When Mackanic was launching Anthro Energy, he took part in StartX’s Student in Residence program in 2020, its full-time program in winter 2021 and also Cardinal Venture’s 2020 cohort. For him, the demo days, path to funding and mentorship in both programs were stand-out points. Demo days, or “demonstration days,” are common finales to accelerator programs, where the startups pitch their idea, progress and business plan to a room full of investors with the hopes of getting funding from them.

“Both have demo days that allowed us to connect with investors, which was crucial for fundraising,” he said. “My Cardinal Ventures mentor was actually one of the investors in my company, which is awesome, and my StartX mentor helped me get one of the big grants that I got.” Mackanic successfully raised a pre-seed round from these investors. “Pre-seed” and “seed” refer to the very first stages of funding in which investors provide funds to support the startup until it can generate profits on its own or is ready for further investments.

As for the experience, Mackanic notes that it’s more self-driven than a structured program. “Cardinal Ventures and StartX are a little bit more of taking it at your own speed and taking advantage of a pool of resources. So there’s not as many requirements or one-on-one meetings — it’s mostly about accessing a really powerful network and attending different seminars and workshops and things like that,” he said. “For all of these programs, you get out what you put in, which can be transformative for a company that puts in the effort.”

While both StartX and Cardinal Ventures have accelerator programs and strong founder communities, Cardinal Ventures is a community of student founders, while StartX skews slightly later stage, meaning that it accepts more mature, bigger startups than those just starting out. As a result, StartX has a significant intake of graduated founders, professors and professionals.

“Cardinal Ventures is more built for people who are excited about something but maybe not decided on it yet, and just helping them get further down that journey on deciding,” Cardinal Ventures co-founder Olivia Moore M.B.A. ’21 explained. “We thought there was a bit of a gap between all of the amazing classes that help you find a team and settle on an idea, and then actually having the conviction to drop out and raise money and forgo your summer internship at [any number of prestigious firms] to work on your company instead,” she said. “The goal is to provide an educational experience for student founders that would get them closer to going out to market if they actually wanted to go full steam ahead on the company,” she added.

In contrast, StartX is targeted to founders who have a clear goal. “For applying to StartX, I recommend having a compelling reason for why you are pursuing a startup and a clear vision for how you will build or already have a world class team,” Mackanic said. StartX companies also tend to raise funds anywhere from the seed stage to more mature stages commonly called series A or B rounds, while Cardinal Ventures companies mostly raise funds for pre-seed and seed rounds.

For Mackanic, both communities were helpful. “StartX is impressive because it has a network of full-time founders and people that are out of school, whereas for Cardinal Ventures, everyone in the cohort is currently in school,” he explained. “I really liked being able to interact with other kinds of students that were going through similar challenges and similar experiences as me, but then StartX with the more experienced network was also very valuable to help me solve pretty complex issues.”

As for what makes a successful team, Moore points to those that were really passionate, dedicated and excited about the problem space they were building in. “They all had a unique, elegant insight in how to make a compelling product there,” she said. Of Cardinal Ventures’ best alumni companies, she notes that “they started with a core vision or mission of the impact they wanted to see in the world. Maybe the specifics of how they went about building that changed even over the course of the program — but even now, three, four, five years later, the company is still working toward the same goal.”

Student groups

Stanford has over a dozen student groups for entrepreneurship, from broad-based groups such as BASES and ASES, to groups catering to many different causes (social, healthcare, space, venture capital), diversity groups (Latin American or women) and majors (computer science, business, law, energy) according to the Stanford Entrepreneurship Network website. The largest and oldest of which is BASES (Business Association of Stanford Entrepreneurial Students), which encompasses all causes, diversity groups and majors.

BASES has over 70 directors and over 5,000 general members on their weekly mailing list. While its leadership is only open to undergraduates, all events are open to the public, including graduate students who often participate in them. Events are hosted on average once or twice a week. According to co-president of BASES Renee Li B.S. ’21, three of their flagship programs are the Frosh Battalion, 100K Challenge and Startup Career Fair.

“The Frosh Battalion [is] aimed at giving freshmen the opportunity to learn about the entrepreneurial ecosystem at Stanford and beyond,” Li explained of the competitive program, which accepted 16 out of about 130 applicants this year. “Mostly we focus on the ecosystem in the Valley: during non-Covid times, we offer treks where we take the freshmen to visit startups and VCs around here and offer them the opportunity to learn about how investors make their decisions and how startups operate, with first-hand experience.”

The 100K challenge is a signature business plan pitch competition where teams with at least one Stanford affiliate can apply, across four categories: consumer, enterprise, health/medical and social impact, with a total prize pool of $100,000. The support that teams can expect comes directly from Silicon Valley. “We have a list of hundreds of VCs that have been very supportive of our Challenge competition over the past years, and we reach out to them every year for their expertise and during the judging process. And a lot of them have been nice enough to offer office hours and workshops for our competing teams as well,” Li said. The challenge has also proved popular with the graduate student body, so much so that part of the prize pool is set aside for the best performing undergraduate team.

Another key event is their startup career fair. “It usually attracts a lot of startups and also a lot of students looking for jobs. A lot of the freshmen told us that they found their first internship at the startup career fair,” Li said.

Li has had the unique perspective of being at all levels of the organization, from a Frosh Battalion member to vice president of the 100K challenge and currently co-president. She feels that it has been a valuable complement to the entrepreneurial classes she has taken at Stanford. “BASES offered me the opportunity to learn about the other sides of entrepreneurship. I could participate in Challenge and listen to the VCs judge the competition and see how they think; and during our treks [to Silicon Valley], I was able to visit some companies and VCs and really see their working experience first-hand.” She also enjoys the community – “it’s really cool to be surrounded by like-minded people in a way that’s not for a class specifically.”

Chloe Pae B.S. ’24 joined BASES in this year’s Frosh Battalion and is an incoming co-VP of Growth. She feels similarly about the community. “In my experience, the best resource available has been other club members,” she said. “I felt so fortunate to have upperclassmen that were willing to talk on the phone, truly whenever I needed, to share their wisdom and advice.” Only joining this year, Pae had a fully virtual experience but one in which she could still experience the strength of the organization. “My favorite experience was participating in the Frosh Battalion pitch competition, where I teamed up with three other Battalion members to design a product for the post-COVID world,” she said. “We got to pitch to venture capital sponsors and receive feedback. I don’t think a lot of frosh can say that they have had such a unique experience!”

As for what BASES will lead to, Pae notes that there are many opportunities to learn about the different parts of entrepreneurship. “BASES has exposed me to the world of entrepreneurship and the varying ways I can participate in it. I still have not decided where I fit best, whether that is in venture capital, startup accelerators or even starting my own company,” she said. “I am confident that further participation in BASES will allow me to explore these avenues, and more, and figure out if entrepreneurship is the right fit for me.”

Other entrepreneurship courses

Stanford’s Management Science and Engineering department, and other engineering departments to some degree, offer a host of entrepreneurship classes that complement the iterative Lean Launchpad-style startup courses. These cover many entrepreneurial topics, including a venture capitalist’s perspective on startups (MS&E 275), entrepreneurial marketing (MS&E 271), entrepreneurial management and finance (MS&E 276) and product management (CEE 250).

“You literally have so many classes that are tailor made to sandbox your idea,” Khullar, who took many of these classes, said. Some, like MS&E 271 and CEE 250, include working in teams to build out a product from an early-stage idea, while others like MS&E 275 and MS&E 276 have less of a project focus but are also strong in bringing real-world perspectives from Silicon Valley venture capitalist practitioners.

“Not only are there a lot of different resources, but it’s a lot of resources that work great together because they cover completely different areas,” said Matthew Hernandez M.S. ’20, who also took most of the classes. “[MS&E] 275 was one of the classes I liked the most, but it was on the opposite side [to MS&E 271] – the venture capital side – but I do think it’s very valuable for entrepreneurship because it’s such a big part of the ecosystem. Knowing how both sides operate is very helpful,” he said, of the entrepreneur vs venture capital roles. He also enjoyed MS&E 276, adding, “that was also a completely separate aspect of entrepreneurship.”

Unlike the Lean Launchpad-style courses, a class like MS&E 271, which still has a team project component to develop an idea or product, the focus is not on rapid iteration or extensive customer discovery. “We did interview probably close to 10 different people over the course of the quarter, but they were more in-depth,” Hernandez said, in contrast to the 100+ required in the Lean Launchpad. MS&E 271 has a greater emphasis on working through content in a syllabus and supplementing it with the project, than Lean Launchpad, where greater focus is placed on the project and interviews.

Khullar also found that taking these courses was a great way to connect with professors. “They can help you connect to the right people to experiment with your startup idea,” she said. Many of these courses have a teaching team of adjunct professors or lecturers that come directly from the industry rather than academia, and so remain heavily connected. “I actually would suggest taking their class if you can,” she said. “Once you take the class, it’s easy to build relationships with them,” she added.

For aspiring entrepreneurs, these classes are also a great way to find co-founders, Khullar said. “Actually, finding co-founders is a very difficult thing otherwise, because it’s hard to find people who really align with your opinions,” she said. “When you have classes 60-people strong, it’s slightly easier to just have open-ended discussions and find people who share your vision.”

Most of these classes are selective by application. The MS&E ones also give preference to MS&E students, especially those in their final year, but all are open to students from any department. However, Hernandez says that the odds of getting in are better than they look. “A lot of people end up dropping or switching classes — so there’s usually more space than it sounds like. And if you don’t make it the first time, you can always try again another year,” he said.