Prominent Stanford geneticist Stan Cohen has paid $29.2 million in damages after losing a lengthy court battle. Cohen was found to have committed “a species of actual fraud and…deceit” in misleading investors into a biotechnology company he founded in 2016. Cohen also admitted to providing inaccurate testimony to the court.

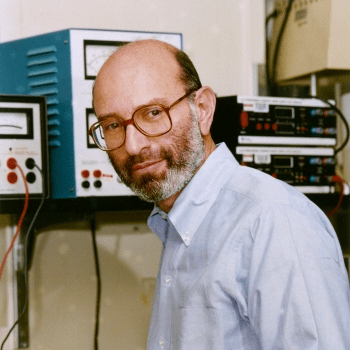

Cohen, a professor in the School of Medicine, was the first geneticist to transplant genes from one living organism to another. The award-winning scientist claimed to have found a cure for the neurodegenerative and ultimately fatal Huntington’s disease. He also claimed the treatment he’d discovered had already been approved by the FDA for use in unrelated treatments. Chris Alafi, a longtime family friend of Cohen and biotech investor, believed him, and invested $20 million into the company Cohen formed to capitalize on the discovery.

What Cohen failed to tell Alafi, according to a June 25 opinion issued by the Superior Court of California in Santa Clara, was that the drug had been withdrawn by the FDA in 1976 for its “potentially deadly side effects” and placed on the “DO NOT COMPOUND” list after causing the loss of limbs and death. (It was also later shown in Cohen’s own experimentation to have a negligible effect on Huntington’s disease in mice with the condition).

Over the course of the case, which was filed by Alafi in Oct. 2018, Cohen testified under oath that he “told Christopher Alafi that the drug had been withdrawn from the market” and said he was “absolutely sure of it” and had “no questions” that he had informed investors about the withdrawal. But under cross-examination, he admitted this was false — Cohen had not informed his investors about the deadly side effects and subsequent FDA decision as he had initially claimed. Judge Beth McGowen, who ruled on the case, wrote that Cohen was “not credible” and his “testimony at times was inconsistent, confusing, and unreliable.”

According to Gardener, this case has caused heartbreak for the Alafi family which shared an “extremely intimate and close relationship” for decades with Cohen before the ill-fated investment. “They live near each other…their families socialized with each other, they went to Yom Kippur services together, they visited each other in the hospital…I mean everyone relied on [Cohen] because he was such a close family friend and because this was a world renowned scientist, so when he tells you something, you tend to believe that.”

Cohen remains employed at Stanford, which now owns the intellectual property from his since-dissolved company. Three senior professors at the School of Medicine, who requested anonymity to speak freely about one of their colleagues, were shocked by the story. One called him a “living legend” in genetics and the other two said they were well aware of Cohen’s many accomplishments as a scientist. Still, one told The Daily that although Stanford might try to separate itself from Cohen’s outside endeavors, “the saga does indeed read like a stain on the University.”

University spokesperson Dee Mostofi wrote in a statement that “Activity related to [the since-dissolved venture] would have been outside of Professor Cohen’s responsibilities at Stanford.” She also wrote that the University had no knowledge of the case, despite it being a matter of public record and involving research performed at the University. She did not respond to questions about whether the University would take any steps in response to Cohen’s behavior.

As of early December, Cohen had repaid the $20 million investment as well as the $9 million in interest ordered by the court, though he has filed an appeal. Cohen and his lawyer did not respond to requests for comment.

This story has been updated to include additional comments from the University and colleagues of Cohen, additional quotations from the June 25 judgment and further clarification of the specific testimony Cohen gave.

A previous version of this article stated that Cohen was found to have intentionally misled investors. Though this was alleged in the complaint, the court did “not find intentional misrepresentation or intent to defraud” by Cohen.