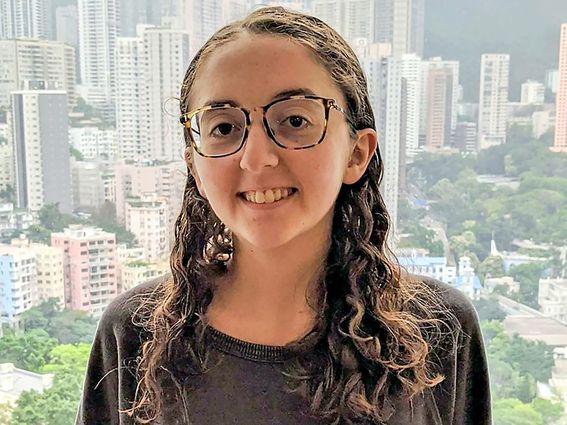

Caroline Ellison ’16, former Alameda Research CEO, apologized in a New York court last week after pleading guilty to fraud and other charges that led to FTX’s collapse. She graduated from Stanford in 2016 with a bachelor’s degree in mathematics.

“I am truly sorry for what I did. I knew it was wrong,” Ellison said, according to a transcript of the hearing released last Friday. “I am here today to accept responsibility for my actions by pleading guilty.”

Ellison, who worked closely with FTX founder Sam Bankman-Fried, pleaded guilty in a court hearing on Monday in hopes of receiving a lighter sentence in exchange. She is currently facing seven counts of criminal charges, including fraud, conspiracy and money laundering. Former FTX co-founder Gary Wang also pleaded guilty on Monday in hopes that he would receive a lighter sentence as well.

In the hearing, Ellison testified that beginning in 2019, she knew Alameda was given “special settings” on its FTX account that allowed it to have “an unlimited line of credit” without having to post collateral, pay interest on negative balances or be subject to margin calls.

She testified that while she was CEO of Alameda, the company “had made numerous large illiquid venture investments and had lent money to Mr. Bankman-Fried and other FTX executives.” She acknowledged that Alameda paid off the loans used to finance its risky investments with FTX customer funds.

“I also understood that many FTX customers invested in crypto derivatives and that most FTX customers did not expect that FTX would lend out their digital asset holdings and fiat currency deposits to Alameda in this fashion,” she said.

Ellison said she worked with Bankman-Fried to provide misleading financial statements to lenders between July 2022 and October 2022.

“We prepared certain quarterly balance sheets that concealed the extent of Alameda’s borrowing and the billions of dollars in loans that Alameda had made to FTX executives and to related parties,” Ellison said. According to Ellison, Bankman-Fried did not disclose Alameda’s special trading settings to FTX investors.

When asked if she knew what she was doing was illegal, Ellison said she did.

Bankman-Fried is currently residing in his parents’ home on Stanford’s campus after being released on a $250 million bond last Thursday. He currently faces eight counts of fraud and conspiracy. Although Bankman-Fried has acknowledged that some of his actions led to FTX’s demise, he denies committing fraud.